Have You Heard About Cloud based Accounting Software Xero?

Xero is the fastest growing Cloud Accounting software in the world. It is used by millions of companies all around the world. The reason is that it is easy to use, affordable, and business owners, accountants, book keepers all love it.

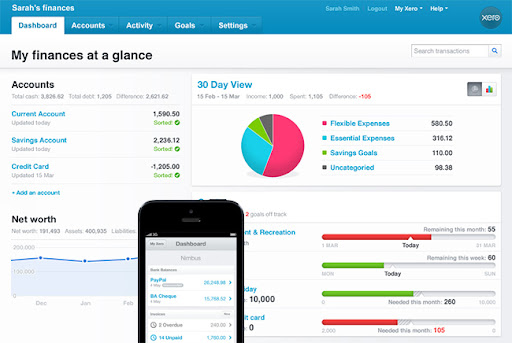

You can see all your accounts – bank balances, invoices, receipts, vendors, customers etc. in one place. And it is available on the cloud. So you have your accounts on your fingertips, anywhere, anyplace, as long as you can connect to Internet.

Xero is available on the Mobile Phones, Tablets, Desktops – and it works for Windows, and on the Mac too. So you are fully covered. It’s time to get real time information about your accounts and finances with easy to use Xero Accounting software.

What is Xero Accounting?

Xero Accounting is a cloud-based accounting software designed for small to medium-sized businesses. It provides a platform for managing finances, including invoicing, bank reconciliation, bookkeeping, and payroll. With real-time updates and access from any device, Xero simplifies financial management and improves business efficiency.

Frequently Asked Questions About Xero Accounting

- What is Xero Accounting software?

- What are the main features of xero Accounting?

- How does Xero Accounting help with business management?

- Is Xero Accounting suitable for small businesses?

- What are the benefits of using Xero Accounting?

- How secure is Xero Accounting?

- What training is available for Xero Accounting?

- Why should I attend the WSQ Funded Xero Accounting MasterClass Training?

- How do I get started with Xero Accounting?

- Do I still need an accountant if I use Xero?

- Is Xero easy to use?

- Why is Xero better than Excel?

- Who is Xero best for?

- What are the benefits of using Xero?

- Why is Xero so great?

- Can Xero talk to Excel?

- Why do accountants love Xero?

- Can I learn Xero by myself?

- Do I need a bookkeeper if I use Xero?

- Can you use Xero without an accountant?

- How long does it take to learn Xero?

- Is Xero online or desktop?

- Can you use Xero on any computer?

- Can I share Xero with my accountant?

- Is Xero linked to your bank account?

- How many companies use Xero?

- Can you use Xero for personal finances?

- Is Xero reliable?

What are the Main Features of Xero Accounting?

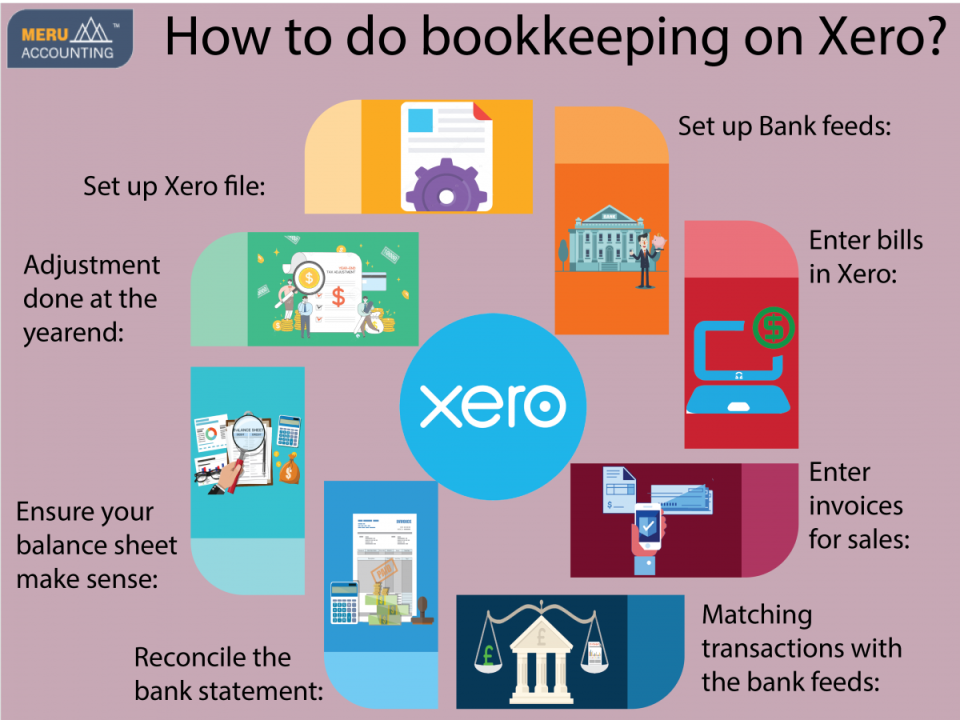

Xero Accounting offers a range of features including:

- Invoicing: Create and send invoices, and track payments from customers.

- Bank Reconciliation: Automatically import and categorize bank transactions. You can connect to most local banks, or load Bank Transaction from a File too.

- Expense Management: Capture, submit, and approve expenses from employees.

- Inventory Management: Track inventory, manage stock levels, and set pricing of your products easily.

- Payroll: Manage payroll for employees, including tax filings.

- Financial Reporting: Generate comprehensive financial reports for better decision-making. Get Profit & Loss Statements, the Balance Sheet, Cash Flow Statements and over 50 other reports.

- Multi-currency Support: Handle transactions in multiple currencies. So if you accept USD, EURO, your local currency or any other currency in the world, you can easily transact in these currencies.

How does Xero Accounting help with business management?

Xero Accounting streamlines business management by automating financial processes, reducing manual data entry, and providing real-time financial insights.

This allows business owners to focus on growth and strategic planning rather than tedious bookkeeping tasks.

Additionally, Xero’s collaboration features enable seamless communication between business owners, accountants, and bookkeepers.

Accountants and book keepers can use separate logins to manage the accounts. And with Access Control, you can restrict access to certain reports or features, based on the user role.

Is Xero Accounting Suitable for Small Businesses?

Yes, Xero Accounting is ideal for small businesses due to its user-friendly interface, scalability, and affordability. It offers essential accounting tools that can grow with your business.

Xero’s cloud-based nature ensures that small and medium business owners to access their financial data anytime, anywhere, facilitating better financial control and decision-making.

What are the Benefits of Using Xero Accounting?

The benefits of using Xero Accounting include:

- Cloud Accessibility: Access your accounts from any device with an internet connection.

- Time Savings: Automate repetitive tasks such as invoicing and bank reconciliation.

- Accurate Financial Data: Reduce errors and improve the accuracy of financial records.

- Collaboration: Easily collaborate with your accountant or bookkeeper.

- Scalability: Xero grows with your business, offering advanced features as needed.

- Integration: Integrate with over 800 third-party apps to enhance functionality.

You can even setup Recurring Invoicing, so that automatic invoices can be generated every week, fortnight or month.

How Secure is Xero Accounting?

Xero Accounting is highly secure, utilizing industry-standard encryption and security protocols to protect your data.

Regular backups, secure data centers, and two-step authentication ensure that your financial information is safe from unauthorized access and data breaches.

The 2 step authentication in Xero is done using the Microsoft Authenticator App. With this, you can be safe, and you can enable or revoke the access of any staff anytime.

What Training is Available for Xero Accounting?

To get the most out of Xero Accounting, comprehensive training is essential.

We offer a 2-day WSQ Funded Mastering Xero Accounting Training that provides hands-on experience with Xero’s features.

This training will cover all the key essential features of Xero Accounting. The Xero course training outline is quite elaborate and detailed.

Section 1: Prepare Accounting Treatment For Small & Medium Companies

- What is double entry accounting?

Xero Accounting Course SkillsFuture Singapore - Setting Up a company & chart of accounts in Xero

- Setting up bank account in Xero & Connecting it with a Bank Feed

- Contact management for Suppliers, Employees & Customers

- Inventory management to track Product and Service items

Section 2: Produce Financial Statements from Xero

- Managing sales transactions – Creating Invoices, Receiving Payments

- Managing purchase transactions – Creating Purchase Orders, Releasing Payments

- Bank reconciliation to get our account payments and receipts in sync with the Bank.

- Financial reporting and tracking of Accounts.

- Budget manager to Track Budgets in Xero

Section 3: Knowledge of Accounting Standards

- Overview of accounting principles and Generally Accepted Accounting Principles (GAAP)

- The accrual principle to accrue Revenue

- Impact of financial standards on financial statement and how to do correct accounting and avoid common mistakes in accounting

This practical, hands-on Xero Accounting course covers everything from setting up your Xero account to advanced financial reporting and analysis.

Our Xero certified trainers in Singapore ensure that you gain practical skills to manage your business finances efficiently and accurately.

Why Should I Attend the WSQ Funded Mastering Xero Accounting Training?

Attending our 2-day WSQ Funded Mastering Xero Accounting Training will equip you with the knowledge and skills to maximize Xero’s potential. Benefits include:

- Expert Instruction: Learn from certified Xero trainers with real-world experience.

- Hands-On Practice: Engage in practical exercises to reinforce learning within the Xero software.

- Comprehensive Coverage: Understand all aspects of Xero, from basics to advanced features.

- Funding Support: Take advantage of WSQ funding to reduce training costs. Other fundings like SFEC, UTAP, SkillsFuture Credits etc. are available too, based on your eligibility.

- Networking: Connect with other business owners and professionals who are involved in Accounting & Finances.

| Training Schedule | |

|---|---|

| 26, 27 Jan 2026 | |

Can I Integrate Xero Accounting with Other business software?

Yes, Xero Accounting integrates with over 800 third-party applications, including CRM systems, eCommerce platforms, and payment gateways.

This allows you to customize and expand Xero’s functionality to meet your specific business needs, enhancing productivity and efficiency.

You can integrate Xero with your Bank, Payment Gateways to accept Visa, MasterCard, and a host of other Cards.

For inventory management, you can use third party apps too if you have more than 4000 items. For smaller number of inventory items, you can manage them in Xero Accounting directly. No need to integrate with other apps.

How do I get Started with Xero Accounting?

To get started with Xero Accounting:

- Sign Up: Create an account on the Xero website. There may be a specific version of Xero for your country. This is better because it can offer custom reports. In Singapore, The Xero version offer Automatic GST Filing using the F5 Report in Xero, only for Singapore.

- Set Up Your Business: Enter your business details and configure your financial settings. You can add your logo also.

- Connect Your Bank Accounts: Link your bank accounts to import transactions automatically. Or load a CSV file of your bank transactions.

- Customize Invoices: Create and customize your invoice templates. Add or remove fields, and add logo etc.

- Attend Training: Enroll in our 2-day WSQ Funded Mastering Xero Accounting Training to gain in-depth knowledge and skills, and master Xero Accounting to get the most out of the software.

By following these steps and taking advantage of professional training, you can efficiently manage your business finances with Xero Accounting.

What Support Options are Available for Xero users?

Xero provides extensive support options, including:

- Help Center: Access a wealth of articles, guides, and tutorials.

- Customer Support: Contact Xero support via email or chat for assistance.

- Community Forum: Join the Xero community to ask questions and share experiences.

- Training Courses: Enroll in our 2-day WSQ Funded Mastering Xero Accounting Training for expert guidance and practical skills.

By utilizing these support resources, you can resolve issues quickly and enhance your proficiency with Xero Accounting.

And with proper Training in using Xero for everyday accounting use, you will be ready to exploit the full features of the Xero accounts in no time.

Do I Still Need an Accountant if I use Xero?

While Xero automates many accounting tasks, having an accountant can still be beneficial.

Accountants provide expert advice on tax planning, financial strategy, and compliance, ensuring your business remains financially healthy and legally compliant.

It is best to use Xero on your own, but to have an accountant review your accounts one in a while, or before major Tax filings or Year end closing, to ensure that you have classified all expenses correctly, and that purchases of Assets is keyed in correctly.

A common mistake is when business owners key in assets purchased directly as an expense. Some assets can be depreciated over a 3 or 10 year period. An accountant is the best person to advise you such transactions.

Is Xero Easy to Use?

Yes, Xero is designed to be intuitive and user-friendly.

Its straightforward interface and easy navigation make it accessible for users with varying levels of accounting knowledge.

For those seeking to deepen their understanding, our 2-day WSQ Funded Mastering Xero Accounting Training offers hands-on experience and expert guidance. It is funded by SSG for up to 70%, and individuals can also use SkillsFuture (Singaporeans only) Credits.

Why is Xero Better Than Excel?

Xero is superior to Excel for accounting purposes because it:

- Automates Tasks: Reduces manual data entry with automated features.

- Ensures Accuracy: Minimizes errors with built-in checks and balances.

- Provides Real-Time Data: Offers up-to-date financial information accessible from any device.

- Facilitates Collaboration: Enables easy sharing with accountants and team members.

- Enhances Security: Protects data with advanced security measures and regular backups.

Efficiency and Automation

Xero is superior to Excel when it comes to efficiency and automation in accounting tasks.

Xero automates many routine processes, such as bank reconciliation, invoicing, and expense tracking, which can save significant time and reduce the likelihood of human error.

Unlike Excel, where data entry and formula setup are manual, Xero’s automated features ensure that financial data is processed accurately and swiftly, enhancing overall productivity.

This automation allows business owners to focus on strategic tasks rather than getting bogged down by administrative details.

In addition to automation, Xero provides real-time financial insights, a crucial advantage over Excel. With cloud-based access, users can view up-to-date financial information anytime, anywhere, facilitating better decision-making.

Xero’s robust reporting tools offer detailed and customizable financial reports, which are more sophisticated and easier to generate than those created manually in Excel.

This capability ensures that businesses have a clear and accurate picture of their financial health at all times, aiding in proactive management and planning.

Collaboration and Security

Xero excels in collaboration and security, areas where Excel often falls short. Xero’s cloud-based platform allows multiple users to access and work on the same financial data simultaneously, promoting seamless collaboration between team members, accountants, and bookkeepers.

This shared access eliminates the need for emailing files back and forth, which can lead to version control issues and data discrepancies. Additionally, Xero’s user permissions feature ensures that sensitive financial data is only accessible to authorized personnel, enhancing security and control.

Furthermore, Xero provides robust security measures that are typically more advanced than those available in Excel.

Xero’s data encryption, secure data centers, and regular backups protect financial information from unauthorized access and potential data loss.

In contrast, Excel files stored on local devices or shared through unsecured channels are more vulnerable to security breaches.

By using Xero, businesses can ensure their financial data is safeguarded with industry-standard security protocols, providing peace of mind and compliance with regulatory requirements.

How Can Xero and Excel Work Together?

Data Export and Import

Xero and Excel can complement each other by leveraging their respective strengths in data management and analysis. Xero allows users to export financial data into Excel, enabling further analysis and manipulation.

This feature is particularly useful for creating custom reports or performing advanced data analysis that might require Excel’s powerful spreadsheet functions. By exporting data from Xero, businesses can take advantage of Excel’s extensive formulae, pivot tables, and charting capabilities to gain deeper insights into their financial performance.

Conversely, users can also import data from Excel into Xero. This functionality is beneficial when initially setting up Xero or when integrating historical financial data from existing Excel spreadsheets.

By importing data into Xero, businesses can transition seamlessly to a more automated and integrated accounting system without losing valuable historical information.

Xero provides specific templates and guidelines for data import to ensure that the process is straightforward and that the imported data is accurate and properly formatted.

Integration and Workflow Enhancement

To further enhance workflow, Xero integrates with various third-party applications, including those that work well with Excel. For instance, users can connect Xero with business intelligence tools that use Excel for advanced data visualization and reporting.

These integrations enable businesses to create a seamless workflow that leverages the strengths of both platforms, optimizing financial management and strategic planning.

By combining Xero’s automated accounting features with Excel’s powerful analytical tools, businesses can achieve a comprehensive and efficient financial management system.

This integrated approach allows for real-time financial tracking and detailed analysis, ensuring that businesses can make informed decisions based on accurate and up-to-date data.

Whether it’s through direct data exports, imports, or third-party integrations, using Xero and Excel together can provide a robust solution that meets the diverse needs of modern financial management.

Who is Xero best for?

Xero is best suited for small to medium-sized businesses, freelancers, and entrepreneurs who need a reliable and efficient accounting solution.

Its scalability also makes it suitable for growing businesses that require more advanced features over time.

Anyone – from a Freelancer to a New Startup to an established business will find it easy to manage the finances and do simple accounting & book keeping with Xero.

What are the Benefits of Using Xero?

The benefits of using Xero include:

- Cloud Accessibility: Access your financial data from anywhere.

- Time Savings: Automate repetitive tasks like invoicing and reconciliation.

- Improved Accuracy: Reduce errors with automated data entry and checks.

- Collaboration: Easily work with your accountant or bookkeeper.

- Scalability: Grow with your business, offering advanced features as needed.

- Integration: Connect with over 800 third-party apps to enhance functionality.

Why is Xero so Great?

Xero stands out due to its user-friendly interface, robust features, and cloud-based accessibility.

It streamlines financial management, offers real-time insights, and supports collaboration, making it an invaluable tool for businesses looking to improve efficiency and accuracy in their accounting processes.

Why do Accountants Love Xero?

Accountants love Xero because it:

- Simplifies Workflow: Automates many routine accounting tasks.

- Enhances Collaboration: Allows easy sharing and collaboration with clients.

- Provides Real-Time Data: Offers up-to-date financial information for better decision-making.

- Ensures Compliance: Helps maintain compliance with accounting standards and regulations.

Can I Learn Xero by myself?

Yes, you can learn Xero by yourself using various online resources such as tutorials, guides, and the Xero Help Center.

However, enrolling in a structured course like our 2-day WSQ Funded Mastering Xero Accounting Training can provide comprehensive knowledge and hands-on experience, accelerating your learning process.

Do I Need a bookkeeper if I use Xero?

While Xero automates many bookkeeping tasks, a bookkeeper can still add value by managing day-to-day financial records, ensuring data accuracy, and handling more complex transactions.

Combining Xero with a professional bookkeeper can provide the best of both worlds.

Can You Use Xero Without an Accountant?

Yes, you can use Xero without an accountant for basic accounting tasks.

However, having an accountant can help with strategic financial planning, tax compliance, and complex financial matters, ensuring your business remains financially healthy and compliant with regulations.

How Long Does it Take to Learn Xero?

The time required to learn Xero varies depending on your prior accounting experience and familiarity with accounting software. Beginners might need more time to understand the basic concepts and functionalities, whereas those with an accounting background could grasp the software more quickly.

Generally, with regular practice and the use of online tutorials and resources, most users can get comfortable with Xero’s core features within a few weeks.

For a more structured and expedited learning experience, enrolling in a comprehensive course like our 2-day WSQ Funded Mastering Xero Accounting Training can be highly beneficial. This intensive training covers all essential aspects of Xero, from setup and basic functionalities to advanced features and integrations.

With hands-on practice and expert guidance, you can become proficient in Xero in a much shorter time frame, ensuring you maximize the software’s potential for your business needs.

Is Xero Online or Desktop?

Xero is an online, cloud-based accounting software, meaning it operates entirely over the internet rather than being installed on a local desktop or server.

This cloud-based nature allows users to access their financial data from any device with an internet connection, providing unparalleled flexibility and convenience.

You can manage your business finances on-the-go, whether from a computer, tablet, or smartphone.

The benefits of Xero being online extend to automatic updates and backups. Users do not need to worry about installing software updates or losing data due to local hardware failures, as all updates and data storage are managed by Xero’s secure servers.

This ensures that you are always using the latest version of the software with enhanced features and security protocols, without any extra effort on your part.

Can you Use Xero on any computer?

Yes, you can use Xero on any computer with an internet connection. Since it is a cloud-based platform, there is no need for any software installation, and you can access your Xero account via a web browser.

This flexibility is particularly beneficial for businesses with multiple locations or remote employees, as everyone can access the same up-to-date information from wherever they are.

Moreover, Xero’s interface is designed to be user-friendly and consistent across different devices.

Whether you are using a Windows PC, a Mac, or a Linux system, you will have the same experience and access to all features. This cross-platform compatibility ensures that all users, regardless of their preferred device, can efficiently manage their financial tasks without any technical hindrances.

Can I Share Xero with my Accountant?

Yes, Xero allows you to easily share access with your accountant, facilitating seamless collaboration. You can invite your accountant or bookkeeper to your Xero account through the user management settings, granting them the necessary permissions to view and manage your financial data.

This real-time sharing capability eliminates the need for manual data transfers and ensures that both you and your accountant are always working with the most current information.

Having your accountant directly access your Xero account can significantly improve efficiency and accuracy. They can perform tasks such as reconciling accounts, preparing financial statements, and offering strategic advice based on up-to-date data.

This collaborative approach not only saves time but also enhances the quality of financial management and decision-making for your business.

Is Xero Linked to your Bank Account?

Yes, Xero can be linked to your bank account to automatically import transactions. This feature, known as bank feeds, allows for real-time synchronization of your financial data, ensuring that your Xero account reflects your actual bank activity.

By automating the import process, Xero reduces the need for manual data entry, minimizing errors and saving time on reconciliation.

The automatic bank feeds also facilitate more accurate and timely financial reporting. With up-to-date transaction data, you can generate real-time financial reports, monitor cash flow, and make informed business decisions.

Additionally, Xero supports multiple bank accounts, allowing you to manage all your financial activities in one central platform, further streamlining your accounting processes.

How Many Companies use Xero?

As of the latest data, over 3 million businesses worldwide use Xero Accounting software. This widespread adoption is a testament to Xero’s robust features, user-friendly interface, and reliability.

Businesses across various industries, from small startups to medium-sized enterprises, have found Xero to be an invaluable tool for managing their finances efficiently and effectively.

Xero’s popularity continues to grow as more businesses recognize the benefits of cloud-based accounting. The ability to access financial data from anywhere, collaborate seamlessly with accountants, and integrate with numerous third-party applications makes Xero a versatile and scalable solution.

Its community of users also contributes to a wealth of shared knowledge and support, enhancing the overall user experience and fostering continuous improvement and innovation.

Can you Use Xero for Personal Finances?

While Xero is primarily designed for business accounting, some users do find it useful for managing personal finances due to its comprehensive financial tracking and reporting capabilities.

The ability to categorize expenses, track income, and generate detailed financial reports can help individuals maintain a clear picture of their personal financial health.

However, it is worth noting that Xero’s features and pricing are optimized for business use, and there may be more cost-effective personal finance tools available specifically designed for individual use.

| Training Schedule | |

|---|---|

| 26, 27 Jan 2026 | |

For those who manage both business and personal finances, using Xero can provide a unified platform to oversee all financial activities. By setting up separate accounts or tracking categories within Xero, users can effectively manage personal finances alongside business operations, ensuring a holistic approach to financial management.

However, careful consideration of cost and functionality is advised to determine if Xero is the best fit for personal finance management.

Is Xero Reliable?

Yes, Xero is highly reliable, offering 99.99% uptime, ensuring that your financial data is accessible whenever you need it. Xero employs industry-standard security measures, including data encryption, secure data centers, and regular backups, to protect your financial information.

These robust security protocols help safeguard against data breaches and ensure that your financial data remains secure and private.

Additionally, Xero’s cloud-based infrastructure means that your data is always backed up and protected from local hardware failures or other potential disruptions. Users can rely on Xero’s consistent performance and dependability, which is crucial for maintaining accurate and up-to-date financial records.

The peace of mind that comes with knowing your financial data is secure and accessible is one of the many reasons businesses choose Xero as their accounting solution.

It’s Time To Learn Xero Accounting

Simply join the 2 Days WSQ Funded Mastering Xero Accounting at Intellisoft Training, and learn to use Xero step by step for your business. Simplify your accounts. Gain the competitive edge!

Learn More at Intellisoft

Intellisoft provides comprehensive Excel, Xero Accounting, Canva, Advanced Excel, Power BI, PowerPoint, Data Analytics Training Courses in Singapore and beyond, where you can learn many more shortcuts, functions, and features of these amazing software.

Join our hands-on workshops at our Training Centre at Fortune Centre to enhance your skills and boost your productivity.

Visit Intellisoft for more details and course schedules for our WSQ Funded Creative Courses.

Intellisoft Training | +65-6252-5033 | info@trainingint.com | Whatsapp us at 9066-9991

Seats are limited, and the course fills up quickly. Hurry and sign up today to take advantage of this unique opportunity!

Join over 30+ Courses with WSQ Funding For Your Career Enhancement